Home Goal: Smart Tool for First-Time Buyers

Andy Thomson on 12 March 2025

For many first-time buyers and renters, buying the first home feels like a distant goal. House prices continue to rise, and saving for a deposit while managing everyday expenses can seem overwhelming. This is where Klink’s Home Goal feature comes in - providing a structured, data-driven approach to help you plan your journey towards home ownership.

What is the Home Goal Feature?

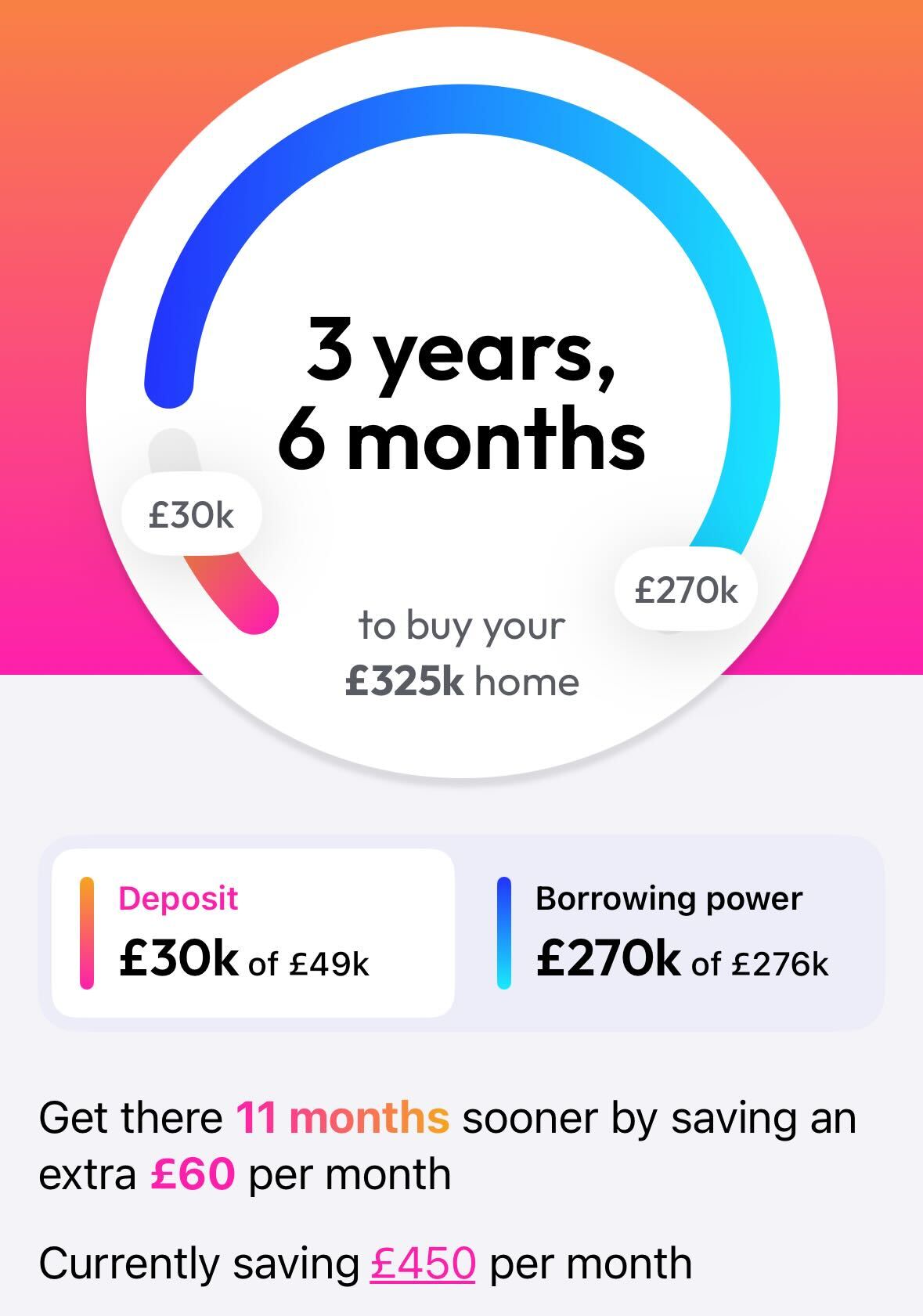

Klink’s Home Goal feature allows you to set a clear and realistic path towards buying a home. By entering details such as your desired home value, target deposit, current savings, monthly savings contributions, and expected salary increases, Klink calculates a personalised timeline, showing exactly when you could reach your goal.

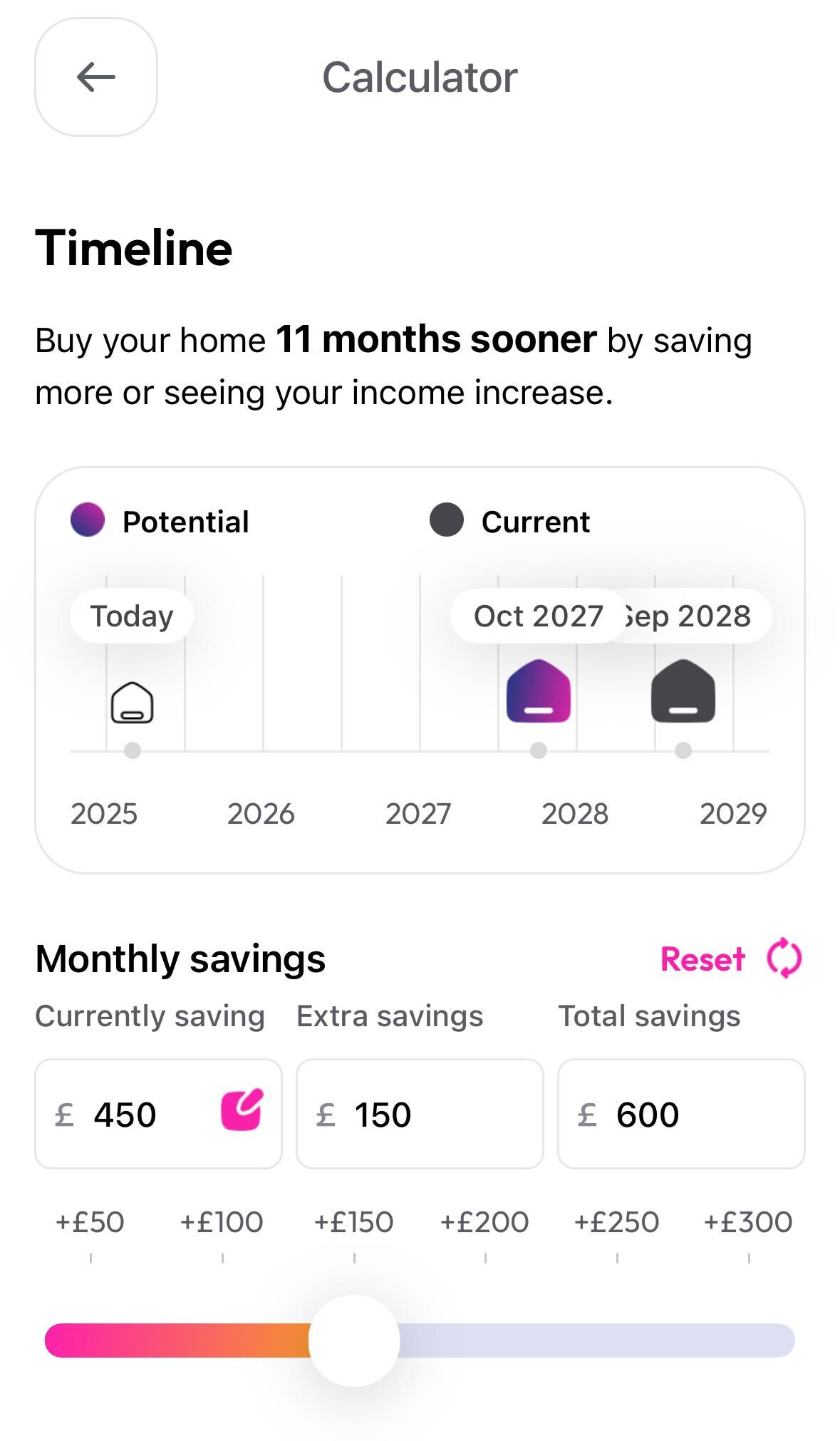

This timeline isn’t static - you can adjust key financial inputs to see how different savings rates or salary increases impact your target date. By giving you control over these variables, Klink helps you make informed financial decisions to reach home ownership sooner.

How Does It Work?

-

Set Your Home Goal

-

Enter your desired home value and the deposit percentage you want to save.

-

Declare your current savings and monthly savings contributions.

-

If applicable, input your expected salary increases over time.

-

-

Get a Clear Timeline

-

Klink uses this data to calculate how long it will take to reach your deposit goal.

-

See a projected completion date based on your current financial situation.

-

-

Experiment with Adjustments

-

Want to speed up the process? Increase your savings contributions and see how it affects your timeline.

-

Considering a higher-paying job? Adjust your expected salary increase and understand the impact.

-

Understand how even small changes in financial behaviour can bring you closer to home ownership.

-

-

Track Progress Over Time

-

Regular updates keep you informed on your progress.

-

Insights from Klink’s open banking integration highlight areas where you can save more and improve your financial readiness.

-

-

See what you can afford today

-

Shows you what you could afford right now if you were to look to obtain a mortgage and buy a house.

-

Along with Klink's mortgage readiness tool you can see if you are able to proceed straight away.

-

Why is Home Goal Important for First-Time Buyers?

Many first-time buyers underestimate how long it will take to save for a deposit or how changing financial habits can accelerate the process. Without a structured plan, saving can feel like an open-ended task with no clear finish line.

Home Goal removes the guesswork by providing a data-driven approach, showing you exactly when you could achieve home ownership and what steps will get you there faster.

Home Goal vs. Traditional Savings: Best for First-Time Buyers?

Traditional savings methods often lack structure, relying on general advice like “save as much as you can” without clear milestones. Klink’s Home Goal is different:

-

Real-Time Tracking - Updates dynamically based on your savings and financial inputs.

-

Adjustable Planning - Test different scenarios and understand how changes affect your target date.

-

Integrated with Mortgage Readiness - Works alongside Klink’s Mortgage Readiness feature to ensure you’re financially prepared when you reach your savings goal.

Home Goal and Mortgage Readiness: A Powerful Combination

Saving for a deposit is only one part of the mortgage journey. When you’re ready to apply, lenders will assess not just your savings but also your financial behaviour. Klink’s Mortgage Readiness feature complements Home Goal by analysing your spending habits, debt levels, and affordability to ensure your financial profile meets lender expectations.

By using both features together, you can confidently approach lenders knowing you’ve taken the right steps to be mortgage-ready.

Take Control of Your Home Ownership Journey

Klink’s Home Goal feature puts you in control, giving you a clear, achievable plan to reach your property aspirations. Whether you’re just starting to save or looking to speed up your progress, Klink provides the insights you need to make smarter financial decisions.

Download Klink today and start tracking your Home Goal. The sooner you start planning, the closer you are to owning your home.

Categories

Recent posts

Tag Cloud

Related Blogs

MORTGAGE READINESS

Jul 17 · 4 min read

The journey from viewing dream properties to getting the keys can be interrupted by an unexpected hurdle: a rejected mortgage application. Here are ten common reasons why your mortgage application can be rejected.

Read MoreFINANCIAL HEALTH

Nov 20 · 4 min read

With Klink’s new features, saving for a deposit doesn’t have to feel overwhelming. See what's new in the app!

Read MoreMORTGAGE READINESS

Mar 06 · 5 min read

Much like a credit report, but tailored to your banking activity, Klink’s Mortgage Readiness Feature analyses your finances using open banking data to give you a clear, actionable mortgage readiness score.

Read MoreWant to know more about Klink?

Make a date with home ownership by joining our growing community